Aged 45 to 70? Urgently consider buying national insurance years

Transitional arrangements for buying missing national insurance years from 2006 to 2016 end on 31 July 2023. (Extended from 5th April). This can be incredibly lucrative, for example many can spend £800 or less and get £5,500 back. Find out more here. Source: Moneysavingexpert.com

For a quick explanation watch this video from Money Saving Expert Martin Lewis.

If you would like to join the pension scheme or discuss your existing pension scheme membership and contributions, please contact our Payroll Department.

All colleagues can join our NEST (National Employee Savings Trust) pension scheme.

For those who have qualifying earnings (see the next question for a definition) the Trust offers active membership to a pension scheme and an employer contribution based on the contribution you decide to make to your pension pot.

For those who do not have qualifying earnings, the Trust offers active membership to a pension scheme to which you can arrange to make contributions. You can make those contributions directly to NEST or you can ask us to collect fixed value contributions from your pay.

What are qualifying earnings?

We use the definition of qualifying earnings as laid out by the Pensions Regulator for the purposes of automatic enrolment. Qualifying earnings are based on your gross earnings (before tax and National Insurance).

Pension contributions are calculated on your earnings between the lower level and upper level of earnings. For the 2023 to 2024 tax year, the lower level is set at £520 per month and the upper level is set at £4,189 per month. These figures will be reviewed annually by the government.

What happens to the contributions?

The contributions will be invested in one of NEST’s Retirement Date Funds, based on your retirement date. Once you have your membership pack from NEST you will be able to review the other fund options and you can move your investment if you wish.

What contributions will be made?

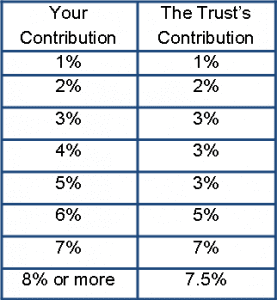

If you have been automatically enrolled to the pension scheme, the minimum contributions will have been applied (i.e. your contribution will be 1% of qualifying earnings which will be matched by the Trust). However, you do have the opportunity to amend your contributions and receive an enhanced contribution from the Trust.

If you have been invited to “opt in” to the Trust’s automatic enrolment pension scheme you can select your contribution level and receive an enhanced contribution from the Trust.

The Trust offers a maximum contribution of 7.5% of your qualifying earnings, which will be dependent on your contributions, see the box below for details.

For more information about planning your pension and retirement savings visit:

https://www.moneyadviceservice.org.uk/en/categories/pensions-and-retirement

Resources:

Pension Wise: a service from MoneyHelper, backed by government

https://www.ageuk.org.uk/information-advice/money-legal/pensions/